The Internet Reigns

| Title: | Behind The News. |

| Subject(s): | |

| Source: | |

| Author(s): | |

| Abstract: | Presents news briefs on computer-related issues in the United States as of October 1999. Factors that can cause telecommunication business alliances trouble; Expectation of companies for installing Extensible Markup Language (XML) to satisfy their customers; Factors that will boost the market potential of XML tools. |

| AN: | 2409893 |

| ISSN: | 8750-6874 |

| Database: | Academic Search Elite |

BEHIND THE NEWS

Global telecom alliances may soon be added to the endangered-species list. These partnerships are in trouble because they've failed to make it easier for users to deploy international networks, according to Christine Heckart, consulting director at TeleChoice, a research firm.

The strategy of many carriers has therefore shifted from alliances to owning and building their own facilities to gain the end-to-end control needed to fulfill their promises to IT executives, says Maribel Lopez, an analyst at Forrester Research. "MCI's merger with Sprint, and AT&T buying IBM's Global Network, are steps in that direction," Lopez says (Oct. 11, p. 177; information week.com/756/56fntel.htm).

But some carriers haven't given up trying. Concert--which was originally an MCI--BT joint venture that fell apart when MCI was sold to WorldCom, and was then recreated by AT&T and BT-last week said that it will double the size of its international IP network. And France Telecom said that it may take over the foundering Global One, an alliance it has with Sprint and Deutsche Telekom. Sprint apparently plans to leave the triumvirate.

Global telecom alliances appeal to IT executives because they usually provide a single point of contact, consolidated billing, and skilled staff. But difficult-to-understand billing, lack of a simple process for getting problems solved, and poor service and support have kept most IT executives from signing with these alliances, according to Heckart. "Their sales forces are fighting, pricing is often difficult to understand, and the services they offer are just too complex for customers to fathom," she says.

Concert may succeed where others are struggling. On its first day of operations as an AT&T-BT venture, Concert's IP network will serve 21 cities in 17 countries and double the number of countries it serves by early 2000. Concert CEO Dave Dorman says the company will spend $1 billion on the network in its first year, which begins immediately following regulatory approval--which is imminent, according to an AT&T spokesperson--and $3 billion during the next five years.

One company that used services from Concert when it was an MCI-BT venture, Eastman Kodak Co. in Rochester, N.Y., has hit no roadblocks. But Kodak would like to have one number to call for problems at sites worldwide and greater geographic coverage. "We listen to numerous providers to check out their rates, reliability, and performance," says Tom Hobika, global network engineer at Kodak. The company uses Concert and other carriers outside the United States.

Henry Fiallo, CIO of Cabletron Systems Inc., a Rochester, N.H., networking equipment vendor, has used one or two services from the same telecom provider rather than deal with global alliances. "The idea of one-stop shopping for international networks has always sounded good, but the question since the outset that has been tough to answer is how seriously members are committed to the alliance," Fiallo says. "If yours falls apart, you're left twisting in the wind."

One of the most troubled alliances is Global One, Heckart says. It needs a leader, preferably one with a network in the United States, as both France Telecom and Deutsche Telekom provide services outside the country. The alliance has yet to turn a profit and lost its CEO in mid-July, fueling speculation that things would worsen. They did two weeks ago, when Sprint CEO William Esrey said Sprint "will transition off Global One."

Cabletron's Fiallo says he would like to see a modicum of security: "Today,

nothing would beat having a written stipulation protecting you against an

alliance breakup."

--Bob Wallace

Maybe the emergence of customer-centric business priorities isn't hot-off-the-press news any longer. With competition heating up and costs rising, companies are working overtime to gain and retain customers at minimal cost. What's new are the technologies that enterprises are putting in place to keep customers happy, outpace the competition, and drive the business forward.

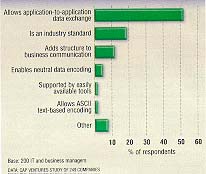

Extensible Markup Language is one of those technologies. Though it's been around for at least two years, demand has increased significantly in the last six months. A Cap Ventures study titled "Understanding the Early Markets for XML" found that while sales of XML products are small today, growth will be exponential in the next few years. More than two-thirds of the 249 IT and business managers surveyed say they're implementing XML in 1999, and 65% plan to increase XML spending in 2000.

What's driving the use of XML? The biggest reason, cited by more than two-thirds of those surveyed, is that XML can provide the basis for new business capabilities that will give them a competitive advantage. Cap Ventures thinks the benefits will come mainly from the way XML will let businesses better share customer information between departments.

Other advantages include new channels and improved ways of delivering information and content over the Internet. Businesses should be able to deliver their content with greater efficiency and precision to customers.

Small companies are much more likely to see the competitive advantages of XML in new products than midsize and large enterprises, while midsize companies see more value in new channels of delivery than other companies. Large companies see more benefits from new business models than companies of other sizes.

What are your company's plans for XML implementation in 2000?

Let us know at the E-mail address below.

Elisabeth Goodridge, Contributing

Editor

egoodrid@cmp.com

If someone gave you a tip on a stock he said would climb from $44 to $1,000 in two years, you'd sit up and pay attention. Well, then, keep your eye on the market potential for XML tools, products, and services because that's just the exponential type of growth that Cap Ventures forecasts.

Why the sudden surge, which amounts to an eye-popping 397% compound annual growth rate? It's because of an increase in company budgets for XML, an increase in the number of companies adopting and implementing XML projects, and an increasing number of applications for XML.

The primary reason most companies cite for using XML is to exchange data across the enterprise. A key secondary reason is its anticipated status as an industry standard.

Different departments will use the technology primarily to facilitate data exchange between documents and databases and between various enterprise applications, either within an enterprise or across the Internet with trading partners. Asked if they will integrate their XML applications with other commercial apps, roughly 50% of the IT respondents indicated they plan to do so. But there's no consensus on just how those XML-aware applications will be integrated.

It turns out that most managers think XML plays a greater role in tuning and improving their internal company plumbing--helping get things done more efficiently--than in completely overhauling processes. XML implementation is seen as critical in increasing information access, external communication, and distribution efficiency.

Cap Ventures points out that although application-to-application data interchange is the primary reason for using XML, fewer consider it a critical component in reducing development costs. Early adopters don't think those development expenses will be reduced until the products and the market mature.

Where specifically will XML products fit in the big picture? Almost everywhere in the enterprise, according to those surveyed. XML will benefit a variety of organizational areas, but the Internet still reigns. If you look carefully at the chart and add order processing and order fulfillment together, it's clear that the combined category is the key business area for XML.

In fact, E-commerce projects dominate the use of XML. Many projects in a variety of applications and across a number of business functions--content management, enterprise resource planning, and supply-chain management--are E-commerce-related.

Isn't it amazing how quickly some trends get started? First a few people try something new, then it seems like almost overnight there's a stampede not to be left behind. That appears to be the case with XML products.

Most businesses are just getting started with XML. While only 10% of respondents are implementing the technology, a substantial majority of respondents have XML in their future. Cap Ventures believes that managers already have identified objectives and resources for implementation needs, but most have yet to discover the specific products and brands necessary for achieving their goals.

At what stage of XML adoption is your company?

A B

Pilot project 19%

Implementing 10%

Don't know 2%

Planning 69%

DATA: CAP VENTURES STUDY OF 249 COMPANIES

As more than half of the companies surveyed report they'll be satisfied with off-the-shelf products, vendors should profit from the huge interest in XML products and services. The highest interest in purchasing XML products is in the document- and content-management area.

But it's puzzling why so few respondents plan to both buy and build XML applications. Perhaps it's because most companies are still in the planning stages and are not aware of the potential need for a combined solution. Or they assume product vendors will provide all required building services as part of the sale.

Do you plan primarily to build your XML-aware systems or buy commercial products? A B Build 39% Buy 32% Both 9% DATA: CAP VENTURES STUDY OF 249 COMPANIES

HTML programmers may want to broaden their horizons and pick up some new skills. Almost three-quarters of the technical managers surveyed believe XML will partially or completely replace HTML. Cap Ventures says the most likely interpretation is that these managers expect XML to play a key role in information encoding, especially for dynamically generated information or information exchanged between applications.

On the other hand, it's reasonable to conclude that users plan to keep existing information already encoded in HTML in that format. And certainly HTML will continue to be used to encode some new documents.

Will XML replace HTML?

A B

Completely 10%

Don't know 12%

Not at all 15%

Somewhat 63%

Base: 49 technical managers

DATA: CAP VENTURES STUDY OF 249 COMPANIES

Enterprise resource planning vendor SAP said last week it anticipates its 1999 revenue growth will be below the 20% to 25% initially expected. SAP's board of directors hopes the company can achieve revenue growth of 15% to 20% for the year, even though third-quarter revenue growth is expected to be just 7%. SAP expects strong fourth-quarter sales for its mySAP.com portal software, which was launched last month.

AMR Research analyst David Boulanger attributes SAP's slowing growth to

increased competition from vendors that are driving deals with new software

offerings, such as customer-relationship management and procurement applications

(see story, p. 22). "Companies have problems to solve, and they're implementing

products," Boulanger says. "SAP may not be first on their mind."

--Tischelle

George and Alorie Gilbert

E-Trade Group Inc. (EGRP- Nasdaq) last week reported a large fourth-quarter loss and shuffled a top executive. CIO Debra Chrapaty moved into a new position in charge of developing technology and strategy for access to financial information using non-PC devices.

For the fiscal fourth quarter, revenue was $173 million, an increase of 84% over the same period last year. For the fiscal year, revenue was $621.4 million, a jump of 85% over fiscal 1998. But the losses mounted because the company spent more than $60 million on advertising. E-Trade lost about $27 million during the fourth quarter, including a one-time charge for its acquisition of TIR Holdings Ltd., a stock clearing company. E-Trade lost $15.2 million during last year's fourth quarter.

The company said Chrapaty will move from her operational role as CIO to head

the company's effort to reach customers via wireless telephones, digital

television, and other types of equipment. Replacing her as CIO is Joshua Levine,

who was previously the global head of equities technology for Deutsche Bank.

--Gregory Dalton

Sun Microsystems (SUNW-Nasdaq) last week posted sharply higher earnings and revenue for its fiscal first quarter. Company officials credit what they say is a renewed focus on Sun's core products: servers and workstations.

"Many of our competitors are talking about E-everything strategies while we're delivering real solutions for the service-driven network," Sun CEO Scott McNealy told analysts during a conference call.

Sun reported revenue of $3.12 billion--a jump of 25% from the first quarter last year. Excluding one-time charges, earnings rose 39% to $274 million.

Meanwhile, weakness in network and Windows NT services slowed revenue growth at Unisys Corp. during the most recent quarter. But cost controls and overseas sales helped the company boost profits.

Unisys reported revenue of $1.87 billion for the third quarter ended Sept.

30, an increase of just 4% over the year-ago period. Net income for the quarter

increased more than 47% over the third quarter of 1998 to $138.4 million. Unisys

said it will realign its services organization to capitalize on demand for

E-business projects, and it will reveal details on Oct. 27.

--Paul McDougall

and Aaron Ricadela

Pricing pressure and shrinking margins for its Pentium processors contributed to a 6.5% drop in third-quarter net income for Intel (INTC-Nasdaq). The chipmaker also said last week that it will acquire DSP Communications Inc., a supplier of digital cellular communications products, in an all-cash deal worth $1.6 billion.

For the period ended Sept. 25, Intel reported net income of $1.46 billion, including charges related to its earlier acquisition of Level One Communications Inc. Without that charge, profit was $1.9 billion. Revenue for the quarter rose 9% to $7.33 billion.

Intel had some good news for large business customers. Paul Otellini, general manager of Intel's Architecture Group, said the company had resolved manufacturing problems associated with the Saber system board, a key component in the company's eight-way server line based on the Xeon chip.

Still, some industry watchers remain cautious about the company's near-term outlook. "There are ongoing issues with pricing, availability, and manufacturing," says Kelly Spang, an analyst with Technology Business Research.

Intel will pay $36 per share for all outstanding shares of DSP. DSP's board of directors has approved the agreement, under which DSP will become a wholly owned subsidiary within Intel's Computing Enhancement Group. The companies don't anticipate any immediate changes to their respective product lines.

The acquisition furthers Intel's plan to become the leading supplier of

Internet-related devices. "Our vision is that the Internet will increasingly go

wireless, especially in the form of handheld devices," Intel CEO Craig Barrett

said in a teleconference. "Our main goal is to expand the market and participate

in that market space."

--Paul McDougall and Tischelle George

Legend for Chart:

B - 3Q '99

C - 3Q '98

A B C

Revenue $7.33 B $6.73 B

Net Income $1.46 B $1.56 B

DATA: INTEL

The Internet professional-services market will reach nearly $80 billion by 2003, according to analysts, and technology consulting firms are increasingly turning to the stock market as a place to raise capital to purchase other companies in an attempt to seize a slice of the market. Thirty-two consulting firms went public in the third quarter, and others, including Collegis Inc. and Cysive Inc., have registered for initial public offerings.

Analysts say the flood of IPOs by consulting firms is being driven by their desire to raise money to expand into services such as application hosting and to acquire other consulting firms so they have the resources to handle larger E-business projects. It's also being driven by the need to offer full E-business services to customers. "Everyone wants to stake out as much territory as they can in this space because there's the belief that E-commerce is the way of the future," says Michael Erbschloe, director of research for Computer Economics Inc.

Erbschloe says there are no clear leaders in the Internet services market, which includes applications hosting and services related to E-business. In addition, the technologies to handle both tasks have become increasingly complex. "Anyone can build a Web site," he says. "Users are looking for companies that can build their Web site, integrate it with legacy systems, understand the business strategy, and help with branding and marketing issues."

Breakaway Solutions Inc., a Web-hosting, E-services, and application service provider, went public Oct. 6, raising $42 million. In February, the company secured $8.3 million in venture capital. It used that money to expand its staff through recruiting and acquisitions. In March, it merged with Applica, an E-business services provider that also hosts customer-relationship management systems. In May, Breakaway acquired WPL Laboratories, an Internet solutions and consulting firm, and in June it merged with WebYes, an Internet application outsourcing and deployment company.

Breakaway president and CEO Gordon Brooks wouldn't say whether the company will use the funds from its IPO to acquire more consulting and services firms. But in its filing with the Securities and Exchange Commission in July, Breakaway said it would use proceeds for "working capital and other general corporate purposes, including possible acquisitions."

Analysts say most consulting firms issuing IPOs are looking to do the same. "These companies want to keep acquiring firms to expand their consulting staff, because experts in this field are hard to find," Erbschloe says. "In addition, by issuing an IPO, they're able to give employees stock options to help increase employee retention, as well as use the stock to formulate more partnerships with other vendors."

Razorfish Inc. did just that. After going public in April, the company acquired i-Cube Inc., which provides E-commerce consulting and integration services, in an all-stock transaction valued at about $677 million.

Before that acquisition, Razorfish acquired five consulting and integration firms. It's also using IPO proceeds to increase employee retention and recruitment. The company plans to expand its human-resources department, hire additional IT personnel, develop its sales and marketing department, expand into international markets, and perform internal systems upgrades.

Other companies that went public this year include Braun Consulting, Luminant

Worldwide, Scient, and Viant. Many of the IPOs have done well (see table,

below). Cysive, a provider of engineering support services for large-scale

E-business operations, is expected to issue its IPO soon, priced between $11 and

$14 per share. The company said it would use the funds to expand its business

and increase its sales and marketing presence.

--Jennifer Mateyaschuk

Legend for Chart:

A - Company

B - IPO Date

C - Offer Price

D - Price On Oct. 4

E - Amount Raised

A B C D E

Razorfish (RASF) April 27 $16 $56.00 $33 million

Scient (SCNT) May 4 $20 $87.88 $60 million

Viant (VIAN) June 18 $16 $61.63 $48 million

AppNet Systems (APNT) June 18 $12 $34.06 $78 million

Luminant Worldwide (LUMT) Sept. 16 $18 $32.50 $73 million

Breakaway Solutions (BWAY) Oct. 6 $14 $45.25 $42 million

DATA: HOOVER'S

Legend for Chart:

A - Company

B - Oct. 13 Price

C - Oct. 6 Price

D - 52 Weeks High

E - 52 Weeks Low

A B C

D E

ADC Telecomm. (ADCT) 43.00 43.81

53.63 17.50

Adobe Systems (ADBE) 117.00 116.56

122.00 31.88

Affiliated Comp. Serv. (ACS) 37.25 37.56

53.00 26.94

Amazon.com (AMZN) 79.94 82.44

110.63 14.97

AMD (AMD) 18.25 19.44

33.00 14.56

America Online (AOL) 111.25 120.00

175.50 22.56

American Mgmt. Sys. (AMSY) 22.38 23.72

40.25 22.38

APC (APCC) 18.06 19.25

27.75 13.09

Aspect Development (ASDV) 27.94 26.88

45.00 6.25

At Home (ATHM) 42.81 46.56

99.00 18.81

AT&T (T) 45.75 46.63

64.08 38.55

Automatic Data Proc. (AUD) 44.88 44.38

46.88 34.78

Axent Technologies (AXNT) 12.06 12.56

40.50 7.69

Baan Co. (8AANF) 13.94 14.56

17.81 6.88

BEA Systems (BEAS) 35.13 38.50

39.25 8.69

Bell Atlantic (BEL) 64.50 66.69

69.50 48.00

BMC Software (BMCS) 60.09 70.00

73.13 30.00

Cabletron (CS) 16.00 17.88

19.94 7.19

Cambridge Technology (CATP) 12.81 13.63

32.25 10.63

CBT Group (CBTSY) 28.00 27.81

30.50 6.69

Ceridian (CEN) 20.06 18.50

40.50 18.00

Check Point Software (CHKP) 87.88 95.75

97.63 15.13

Ciena (CIEN) 35.56 35.81

42.81 8.13

Cisco Systems (CSCO) 70.31 71.92

73.56 24.97

Citrix Systems (CTXS) 61.31 65.69

69.94 26.50

Comdisco (CDO) 19.00 18.81

30.88 10.75

Compaq Computer (CPQ) 22.06 22.25

51.25 20.00

Computer Associates (CA) 55.88 62.63

63.44 32.13

Computer Horizons (CHRZ) 12.69 12.31

30.13 9.25

Computer Sciences (CSC) 64.25 64.75

74.38 48.75

Compuware (CPWR) 27.28 26.00

39.91 16.38

Data General (DGN) 22.25 23.00

23.69 9.50

Dell (DELL) 44.44 43.31

55.00 25.50

Documentum (DCTM) 26.13 25.50

54.13 9.38

EDS (EDS) 51.00 53.31

67.38 32.75

EMC (EMC) 71.00 76.00

78.00 25.81

Epicor Software (EPIC) 5.75 6.00

14.00 3.53

Ericsson LM Telephone (ERICY) 33.31 32.69

35.25 19.13

Exodus (EXDS) 65.56 69.50

89.75 5.81

First Data (FDC) 44.94 45.94

51.50 20.63

Gateway (GTW) 51.31 49.63

54.75 21.25

Hewlett-Packard (HWP) 83.50 89.13

118.44 49.63

Hitachi Ltd. (HIT) 110.31 109.50

114.88 45.13

Hummingbird (HUMC) 21.00 22.63

26.06 14.00

Hyperion Solutions (HYSL) 20.38 20.94

36.13 9.88

IBM (IBM) 105.25 119.19

139.19 63.28

Inacom (ICO) 8.94 8.75

21.13 7.06

Informix (IFMX) 6.97 7.28

14.00 4.03

Ingram Micro (IM) 12.75 13.00

50.38 12.56

Intel (INTC) 72.13 76.94

89.50 40.75

i2 Technologies (ITWO) 51.75 45.00

57.00 12.25

J.D. Edwards (JDEC) 20.94 19.81

38.50 10.88

Keane (KEA) 21.13 23.06

43.63 17.25

Kronos (KRON) 42.75 37.25

54.50 18.33

Legato Systems (LGTO) 48.44 48.06

50.63 15.06

Lemout & Hauspie (LHSP) 33.81 34.31

46.00 25.75

Lucent Technologies (LU) 62.63 64.44

79.75 31.81

MCI WorldCom (WCOM) 74.88 70.88

96.77 45.81

MicroAge (MICA) 2.59 2.13

18.75 2.00

Microsoft (MSFT) 91.06 93.69

100.75 47.88

MicroStrategy (MSTR) 69.75 70.75

75.94 14.69

Motorola (MOT) 90.38 92.75

101.50 44.44

NCR (NCR) 27.50 29.63

55.75 27.13

NEC (NIPNY) 106.38 102.38

111.50 32.00

Network Associates (NETA) 17.88 19.31

67.69 10.06

Newbridge Networks (NN) 23.00 25.31

39.88 15.44

Nokia (NOK) 97.00 96.13

100.44 34.06

Nortel Networks (NT) 55.94 53.81

59.38 14.50

Novell (NOVL) 19.75 21.00

31.19 11.44

Open Market (OMKT) 14.50 13.88

27.00 5.00

Oracle (ORCL) 47.44 45.88

47.81 16.17

PeopleSoft (PSFT) 15.56 17.13

26.11 11.50

Policy Mgmt. Sys. (PMS) 20.94 23.25

57.75 21.50

Qualcomm (QCOM) 204.34 204.31

224.69 20.38

Rational Software (RATL) 31.13 31.06

40.00 13.63

RSA Security (RSAS) 29.81 30.25

34.00 7.91

Saga Software (ACS) 13.75 14.63

20.75 4.75

SAP (SAP) 35.00 41.38

44.88 23.75

Sapient (SAPE) 88.25 95.06

108.75 29.25

SBC Communications (SBC) 52.13 51.81

59.94 41.56

Seagate Technology (SEG) 29.50 31.75

44.25 20.63

Siebel Systems (SEBL) 83.00 83.31

91.63 16.13

SGI (SGI) 10.44 10.75

20.88 8.19

Sterling Commerce (SE) 22.69 22.31

46.44 17.94

Sterling Software (SSW) 20.56 20.38

30.63 18.13

Storage Technology (STK) 14.75 19.63

41.63 17.25

Sun Microsystems (SUNW) 89.38 97.56

99.44 21.81

Sybase (SYBS) 11.00 11.13

13.44 4.50

Symantec (SYMC) 38.69 38.50

40.13 8.69

Tellabs (TLAB) 60.31 59.75

74.00 18.56

Texas Instruments (TXN) 85.94 92.31

94.13 24.88

3Com (COMS) 30.25 30.00

51.13 20.00

Transaction Systems Arch. (TSAI) 27.56 27.63

51.00 24.19

Unisys (UIS) 42.25 46.19

49.69 21.13

Veritas Software (VRTS) 83.13 85.56

88.00 16.00

Vodafone AirTouch (VOD) 49.50 47.38

52.94 22.59

WebTrends (WEBT) 39.44 40.69

84.00 22.00

Whittman-Hart (WHIT) 38.81 36.44

39.44 17.00

Xerox (XRX) 29.31 42.19

63.94 30.00

Yahoo (YHOO) 167.94 175.75

244.00 54.25

MicroAge (MICA) 22.1%

i2 Technologies (ITWO) 15.0%

Kronos (KRON) 14.8%

Ceridian (CEN) 8.4%

Whittman-Hart (WHIT) 6.5%

The Week's Losers

Xerox (XRX) -30.5%

Storage Technology (STK) -24.8%

SAP (SAP) -15.4%

BMC Software (BMCS) -14.2%

IBM (IBM) -11.7%

After posting strong third-quarter earnings and forecasting

solid growth for the fourth quarter, i2 Technologies was up.

Xerox plunged after the company said its third-quarter

earnings would fall due to increased pressure from

competitors and lower productivity from its sales force.

StorageTek fell after it warned third-quarter profits will

fall significantly short of estimates.

Do you remember the first time your math teacher told you that a negative number multiplied by a negative number generates a positive number? Your first instinct was probably to go home and tell your parents how dumb your teacher was. As mathematicians like to say, however, math is based on proof, not hypothesis.

PeopleSoft Inc. (PSFT-Nasdaq) and Vantive Corp. (VNTV-Nasdaq) appear to agree with the mathematicians. Both companies already preannounced dismal earnings for the third calendar quarter. Revenue has been sluggish, and both have been struggling lately. So why would PeopleSoft want to buy Vantive, a leading customer-relationship management and sales-force automation vendor with emphasis in call-center and customer-service operations? Obviously, PeopleSoft thinks that buying Vantive gives it a strong vertically integrated product that can be incorporated into its back-end enterprise resource planning application. This can only be helped by the two companies' long-standing business relationship.

PeopleSoft said it would acquire Vantive for 0.825 shares of PeopleSoft for each share of Vantive, or about $433 million, based on PeopleSoft's stock price on the day the deal was announced. As with many such announcements, investors sold shares of the acquiring company on the news. Vantive's stock rose more than 30%.

The real question, though, is whether this "new math" will eventually work. Besides being a solid front-end application vendor, Vantive has good business relations in the international arena and more than 800 customers; PeopleSoft has strong business ties within the United States and more than 3,000 clients. The marriage could be complementary in opening doors. I could easily argue, however, that the companies have been working together for some time and the relationship has not resulted in booming business on either side.

Let's suppose that Y2K is an event of the past; in other words, we are now in calendar year 2000. The ERP pipeline has been building again, and PeopleSoft has competitive vertical applications to offer customers. The real question is, does anyone care? My bet is that the sale allows PeopleSoft to be slightly more competitive in the request-for-proposal process with the SAPs and Oracles of this world. But at the end of the day, it just gets PeopleSoft back in the game.

Another issue may be that some clients prefer Clarify, Siebel, or other leading CRM and sales-force automation vendors to the Vantive product line. That has been the case for a while, even though Vantive has been out for some time and remains a technologically strong product choice. This also doesn't change the macro landscape, where larger deal sizes result in longer sales cycles as well as uneven revenue and profit patterns. Also, no matter how smoothly a merger is expected to go, it's never seamless. My biggest concern is whether combining the two companies, given their current operational issues, will extend the recovery period.

I don't expect any Securities and Exchange Commission or Justice Department concerns over either compliance or competition and market share. PeopleSoft continues to have a pristine balance sheet. The company has 260 million shares outstanding, but the acquisition will add another 23 million shares. PeopleSoft has said it expects weak revenue and earnings per share for the most recent quarter, with revenue in the range of $290 million to $310 million. Earnings per share is projected to be 0 to 2 cents. The company pipeline is improving, and the Vantive deal should be accretive to earnings, according to management, as early as 2000. I'll take a wait-and-see attitude on this item.

Vantive, in its announcement, said third-quarter 1999 earnings per share would be around minus-16 cents to minus-18 cents on revenue of $42 million to $43 million. Both ranges were significantly below Wall Street expectations.

This combo would not be my first investment choice, but my math tells me that

the combined company is better than the two companies separately. But like a

good mathematician, I still require proof.

William Schaff

Regrettably, I was not among the thousands of people at Internet World in New York this year. The fashion show, which featured models sporting new wearable wireless devices, sounded great, but my feminist conscience caused me to boycott it. The conference's Web site indicated that the only women featured at the event were the winsome ones in the fashion show. (The five keynote speakers were all men, and I've already attended speeches by four of them.)

My boycott meant that I missed seeing the many Santa Claus clones roaming the Javits Center promoting a new Web site called IveBeenGood.com. But I heard all about them from a Bentley College colleague. Ellen Foxman, a marketing professor, burst into my office last week. "You've got to see this site," she exclaimed. "At Internet World, hordes of Santa Clauses urged attendees to log on."

I dutifully typed in "IveBeenGood.com," commenting that I deserved a nice present for being in my office on such a beautiful autumn day, when I'd rather be climbing Mount Monadnock with the rest of the New England leaf-peeping crowd. As the Web page revealed itself, I noted a message attached to a graphic of a cheerily wrapped gift. "Would you like to have a one-click holiday?" it read, followed by a checklist of services: "Locate gifts at any online retailer! Build your wish list of online gifts! Share your wish list with the world!" and so on.

"This looks good," I started to say, until Ellen pointed to the upper right-hand portion of the screen, where a message announced, "Coming Soon!" The IveBeenGood Web site is in fact vaporware.

This prompted Ellen to launch into a Socratic version of Retailing 101 (and no tuition charge! Now that's a gift of collegiality). "When do you think retailers make their greatest profits?" she asked. "In December?" I guessed. "In the entire fourth quarter," she corrected me. "Oh well, at least by now lots and lots of people know that IveBeenGood is coming," I suggested. "No," she sighed in exasperation. ("These MIS people," she was probably thinking. "They have no inkling of how retailers actually make money.") "By now, lots of people know that this company has missed a crucial deadline. It's Oct. 11, for crying out loud!"

After she calmed down, Ellen patiently explained that no self-respecting retailer would begin the fourth quarter with a half-baked holiday-season campaign. "That Web site should have been fully operational by September," she insisted. "At Internet World, something like 50,000 people were exposed to their marketing message--and then were unable to take any action on it!"

IveBeenGood is certainly not alone. In September, an outfit called L2o Tubes (a division of Delta Cycle Corp.) used showgirls dressed as surgeons to promote a new self-mending bicycle tube at the Interbike trade show in Las Vegas. Apparently the exhibit was a big hit, but the L2otubes.com Web site was still not up and running in October, much to company president Erroll Drew's chagrin.

I don't know why IveBeenGood has been tardy, but a wild guess places at least some of the blame on its Web-site developers. Plenty of great ideas are held up because of poor communication between the marketing department and systems developers.

It could be that marketing never explained to the systems people the importance of being up and running at summer's end. Or maybe marketing did set a September deadline, but the developers didn't have the project-management discipline to meet it. (Perhaps they made a list, but didn't check it twice.) It may even be that the developers knew they could not meet the deadline, but just couldn't face breaking that bad news to their client. That's more than naughty--it's not at all nice. Our clients should not have to explain their deadlines to us--we should have the discipline to meet them, or at least the ability to offer ample warning of delays.

So systems developers, take heed: The next time marketing asks for your help,

remember that Santa Claus may not be watching to see whether you've been naughty

or nice, but your company's customers will. So don't be a grinch!

Janis L.

Gogan

As Internet sites such as Amazon.com and ESPN.com incorporate more dynamically generated content, caching strategies used to speed the creation and delivery of pages are getting more sophisticated as well. The most promising new caching method to hit the Internet is the intelligent server-side caching engine.

In the beginning, caching strategies reflected the generally static nature of Web-page creation and assumed that the content of any given frame would usually remain unchanged from moment to moment. The browser viewed every URL as a distinct item and was unaware of the application running on the server. The rules for page caching were simple: A page would be held for a predetermined amount of time or cleared each time the user reloaded the browser.

As Internet traffic began to accelerate, a new type of caching evolved. This time, the focus was on the network, and the goal was to reduce traffic between locations on the Web. This strategy established the use of remote proxy servers on company networks to create a store of Web pages for access by computers on the company LAN. Ultimately, these proxy servers began to migrate up-network, eventually taking the form of network-caching appliances at the Internet service provider level.

While problems with Internet traffic remain, a new performance concern has arisen: the time required to create dynamic HTML pages. This bottleneck is caused by the application server, which is responsible for most of the server-side processing required for dynamically generated pages. While static Web sites can return pages to the user in a few milliseconds, the fastest dynamic pages today require from 15 milliseconds to 100 milliseconds and up, depending on the complexity of the page and any associated database calls. The challenge posed by the increased use of dynamic pages has required software designers to come up with new caching strategies.

One option that presents a number of advantages is the server-side or "cache-forward" cache. To date, server-side caching strategies have taken two approaches. In one scheme, the application server itself is also responsible for caching pages. While this is a relatively straightforward approach, it comes with a significant performance penalty.

A second approach is the intelligent server-side caching engine. This is essentially a reverse proxy strategy, in which the application proxy server is a lightweight filter that is co-resident with the application server on the Web server. The caching server acts as a proxy between the Web server and the application server. Dynamic pages are created by the first user of a certain profile to call the page. The page then resides on the server until the information in those pages changes. Subsequent users calling the same page see a copy of the original cached page. Parameters for access to and management of these cached pages are established by the Webmaster and executed by the application server.

Building a dynamic page for each request is clearly a waste of computational power and a needless drag on the server. In fact, within sites utilizing this caching approach, we've seen that as many as four to five of every six requests are to a prebuilt page. Using this intelligent server-side strategy provides a performance boost of five to six times over internal caching systems, and lets the Web site serve just-in-time dynamic pages as fast as static pages, even as it cuts overall load.

The server-side proxy has advantages for programmers as well. By locating the caching engine within the application server, the control over when and how to rebuild or remove cached pages is greatly simplified through tighter integration with the application. Rather than rely on metatags to prevent a page from being cached, programmers can include calls to clear a single set of pages and its variations, a directory of pages, or flush the cache on the entire site. Other tags can set expiration dates on pages. The caching server can also communicate with other servers in a cluster and synchronize their caches across multiple file servers.

As Web sites continue to grow--and users place a premium on the ability to

interact dynamically while still demanding the performance of static

pages--intelligent server-side caching will become the next logical step in

caching strategy.

Bob Matsuoka

In My Humble Opinion is an occasional column expressing the opinions of InformationWeek's readers. Submissions of up to 750 words can be sent to imho@cmp.com. Only writer being considered for publication will be contacted.

So what was Steve Ballmer, president of Microsoft, doing as the speaker-of-honor at last week's Gartner Group Symposium/IT Expo 99 conference in Orlando, Fla., pretending that there isn't bad blood between the companies? Gartner Group said last month that the cost of migrating corporate desktops to Windows 2000 could be excessively high, leading Microsoft spin doctors to question Gartner's sources. And last week, at the same show Ballmer was attending, analyst Tom Bittman said changes in the way Microsoft packages and licenses its software will raise costs for customers. A Microsoft spokesman countered that any new licensing plans would complement current programs, and faulted Gartner for citing years-old examples. "Gartner knows we've addressed these issues," he says. "We disagree completely."

Priceline.com filed suit in U.S. District Court against Microsoft last week, claiming a hotel-price-matching service on Microsoft's Expedia travel site violates Priceline.com's patents. According to the lawsuit, Microsoft launched its service after marketing and licensing negotiations between the companies broke down. In a news release, Priceline.com recounted a meeting last summer between Bill Gates and Priceline.com founder and vice chairman Jay Walker, during which "Mr. Gates surprised Mr. Walker by informing him that Microsoft had no intention of allowing patent rights to stand in its way." The release says Gates told Walker lots of companies were suing Microsoft, and that he could, "in effect, get in line."

Corel's flamboyant CEO, Michael Cowpland, was charged last week by the Ontario Securities Commission with insider trading, and could face up to two years in jail and at least a $1 million fine. The charges date to May 1997, when Cowpland traded 2.4 million shares of Corel stock through his holding company, MCJC Holdings. A month later, Corel reported a surprise $32 million loss for its third quarter, and the stock tanked. In a statement, Cowpland said, "I'm looking forward to finally having a chance to clear my name." A hearing is scheduled for Oct. 28.

Pay attention to Epiphany, a rising star in the Internet personalization software space. Online retail powerhouse Amazon.com signed on last week to use Epiphany's E.4 suite of online customer management applications, which track information such as Web pages visited, products purchased, and customer demographics. The companies declined to disclose terms of the contract, but the deal is a coup for Epiphany. Also, Epiphany is rumored to be shopping for an online marketing software vendor, and fingers point to Rubric. An Epiphany spokesperson says the company has no formal agreements with any third-party vendors, but that the company is "pursuing partnerships and alliances with marketing automation vendors."

In the wake of Connecticut pulling the plug on its plan to outsource IT, the state is forming an "E-government group" that will help its agencies develop services on the Web for internal use by state employees, as well as services for state residents, such as online automobile registration. The group will tackle some of the IT work EDS would have done had the outsourcing plan not been canned, says Connecticut CIO Rock Regan. Bob O'Connor, director of IS for the state's social services agency, has been named director of the new group, which will begin operations early next year after the state completes its Y2K work.

Frost & Sullivan last week published a report that puts the market

for online gambling software and services at $835 million last year, an increase

of more than 100% over 1997, and headed for $11 billion by 2005. The report says

the ability to gamble online has been significantly improved through technology

such as Java browsers and graphics accelerators. Also, software developers and

operators say laws prohibiting online gambling will be effectively unenforceable

and that people who wish to gamble online will do so regardless. Consequently,

the report says, "market participants march forward despite legal

uncertainties."

John Soat

That's the spirit! Such free enterprise initiative warms my heart-and to heck with the ethics and morality! March forward with an an industry tip, at jsoat@cmp.com or phone 516-562-5326 or fax 516-562-5036.

On Nov. 15, you're scheduled to give the executive committee a presentation called "IT-Driven Business Opportunities in the Coming Year." That gives you about four weeks to look into the future and the soul of your company and its customers, and then analyze how you will help create innovative new products and services.

The project manager in you keeps starting the internal discussion by saying, "It's a 45-minute presentation and there are 28 days until then, so I've got to generate 1.6 minutes of content per day," but your MBA alter ego proposes to the in-brain review board that you center the presentation on that new set of ROI metrics you just read about. You swallow hard and, feeling a tad desperate, you're about to go down the "Debating the Technical Merits of Linux Vs. Windows 2000" path--inspired by some expensive training programs you've just mandated for your top technical people. You discover some overheads in your desk from a not-too-ancient presentation called "Beyond the HR Department: The Corporate Intranet as a Strategic Information Tool," but the survival instinct deep inside your brain nixes that one as a patina of perspiration settles across your brow. And then you spot a business card you got just last week on a sales call you made with the CEO to a fast-growing customer that kept asking your company to commit to things you weren't really ready to commit to. But the CEO committed to them anyway, a decision that on the ride to the airport triggered his inspired discussion on "Why we have to stop doing what is comfortable, and instead do what customers and prospects want."

You can feel in your bones that you've got the inspiration you need, and that inspiration is predicated on the view that the customer is at the center, orbited by you and your suppliers, your trading partners, and your competitors. And that by seeing you and your company as an integral element in that value network, you can envision a greater range of ways in which you can impart more value to customers. It's a world view that allows a "car company" to get into financial services and digital-entertainment delivery, and a "bank" to offer Web-hosting services for small businesses and office-supplies procurement for large companies.

But that means a whole new set of dynamics in the relationships between you and your suppliers, you and your business partners, you and your customers, and among all of you collectively--is your organization ready for that? You wonder how open your company will be with pricing and cost information with suppliers. (In a recent InformationWeek Research survey of 200 IT executives, we asked, "Does information about a customer order or inquiry flow to your suppliers?" Just 7% said yes, frequently; 10% said yes, occasionally; 21% said no, but we plan to; and 62% said no/never. Air getting a mite thin up there in the rarified stratum of high-change innovation?) As you daydream a bit more, you think of that scene from The Miracle on 34th Street where Macy's wins customer loyalty by referring shoppers to competitors if Macy's doesn't have what they want ... and you wonder how far your company would go toward such an idea ... and then you think that the real issue is about ensuring you're so entangled in such a powerful and flexible value chain/network that there's no way you won't be able to get customers exactly what they want and when they want it. Because it's really starting to hit you that what you are and what you will be is no longer a function of what you have been; rather, it's a pure play of what customers want and need.

So you take the head of customer service to lunch to chat about the questions and complaints his group has been fielding, and you plan to spend most of the afternoon with the marketing department to get the latest impressions of how the market is behaving. And you decide to change the name of your presentation to "Customer-Driven Business Opportunities in the Coming Year."

PHOTO (COLOR): SECURITY WANTED: "Nothing would beat having a written stipulation protecting you against an alliance breakup," says Cabletron Systems CIO Fiallo.

The Internet Reigns

Huge Growth Potential

The Read Ahead

Data Exchange Remains Key

Where XML Is Critical

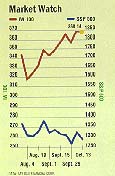

Market Watch Value as of the close of U.S. markets on Oct. 13, 1999. The InformationWeek 100 Stock Index, a comprehensive basket of technology stocks, was pegged at 100.00, on March 1, 1965.

~~~~~~~~

By William Schaff and Janis L. Gogan

William Schaff is chief investment officer at Bay Isle Financial Corp. in San Francisco, which manages the InformationWeek 100 Stock Index. You can reach him at bschaff@bayisle.com

Janis L. Gogan, a professor at Bentley College in Waltham, Mass., consults

and conducts research on emerging IT issues and management practices. She can be

reached at jgogan@bentley.edu.