Capital Budgeting Lecture

Recall the First Principles of Corporate

Financial Decisions:

-

Invest in projects that

yield a return greater than the minimum acceptable hurdle rate.

-

Choose a financing mix that minimizes the

hurdle rate and matches the assets being financed.

-

If there are not enough investments that

earn the hurdle rate, return the cash to stockholders.

In the Capital Budgeting decision arena, any useful decision tool should:

Consider actual cash flows.

Consider timing effectively.

Consider risk.

Be adaptive to different situations.

Be understandable to non-financial types.

Payback Period (PB)

Indicates how long it takes for cash inflows to repay the initial investment

in a project.

To Calculate:

If the expected cash flows are all the same, then PB = Initial Cost

/ CF

Example (Project 1 on the handout): PB = 2000/330 = 6.06 Years

If the cash flows are not all the same, you simply sum the cashflows

until the total exceeds the cost of the project. You can use interpolation

to narrow the result down to the desired level of accuracy.

Problems with Payback Period:

- Fails to consider timing effectively (no discounting or cashflows).

- Generally is used with an arbitrary cutoff point.

- Ignores cashflows past the cutoff point.

- Does not directly consider risk .

Discounted Payback Period (DPB)

DPB is very similar to PB except that it uses discounted cash flows

instead of non-discounted cashflows. The advantages of DPB over PB are:

- It provides a better consideration of timing of cashflows.

- It provides a better consideration of risk if the discount rate is

chosen correctly.

However, it still may suffer the problems of an arbitrary cutoff point

and failure to consider cash flows past the cutoff point.

Average Return on Investment (ROI)

This class of tools includes similar measures with names like Accounting

Rate of Return, Book Rate of Return, Return on Book Value, etc. Do not

confuse this with the Internal Rate of Return (IRR).

To Calculate:

The example uses a very simple definition: Avg ROI = Avg CF / Cost

Problems with ROI:

- May not use actual cashflows.

- Ignores (and even masks) timing by using the average cashflow, thus

assuming that all cashflows are equal.

- It does not directly consider risk, and even masks variability by using

the average.

- It has no standard definition.

Net Present Value (NPV)

NPV is the strongest method for estimating the value of an investment.

It effectively incorporates timing and risk, if properly used. Most important,

it provides an estimate of the value created or destroyed by engaging in

an investment project.

NPV > 0 indicates that value will be created.

NPV < 0 indicates that value

will be destroyed.

NPV Shortcomings:

- NPV is not easy to understand in its raw state.

- NPV is easily abused.

- NPV is not directly comparable across projects with different costs

or lives.

- NPV looks too scientific. Its users sometimes forget that it is only

and ESTIMATE that depends on the ASSUMPTIONS on which it is based.

Profitability Index (PI)

Profitability Index allows the comparison of projects with different

costs by showing the Net Present Value per dollar of invested capital.

PI is computed one of two ways:

NPV ÷ Project Cost

Present Value of Future Cash Flows ÷ Project Cost

Both provide the same information,

but the first method gives a PI greater than zero for positive NPV projects

and the second method gives a PI greater than one for positive NPV projects.

The decimal portion of both gives the NPV generated per dollar of investment.

While PI helps in the ranking of projects, it cannot be used in isolation.

In the presence of a capital constraint, the objective is always to maximize

the total NPV of invested capital.

Equivalent Annual Annuity (EAA)

EAA allows the comparison of projects with different expected life spans

by providing a measure of the NPV generated per year of a project's life.

The computation of EAA is simply to determine the equal annual payment

(annuity) that would have the same present value as the NPV of the project.

For example, consider Project 7 on the handout. It has a 5 year life

and an estimated NPV of $165. Its EAA is computed as follows:

| PV |

-165 |

| FV |

0 |

| n |

5 |

| i? |

10 |

| PMT? |

43.53 |

The EAA lets us think of this project as generating $43.53 of NPV per

year rather than thinking of it as generating a one-time NPV of $165.

This project can be compared with others with different life spans on this

basis.

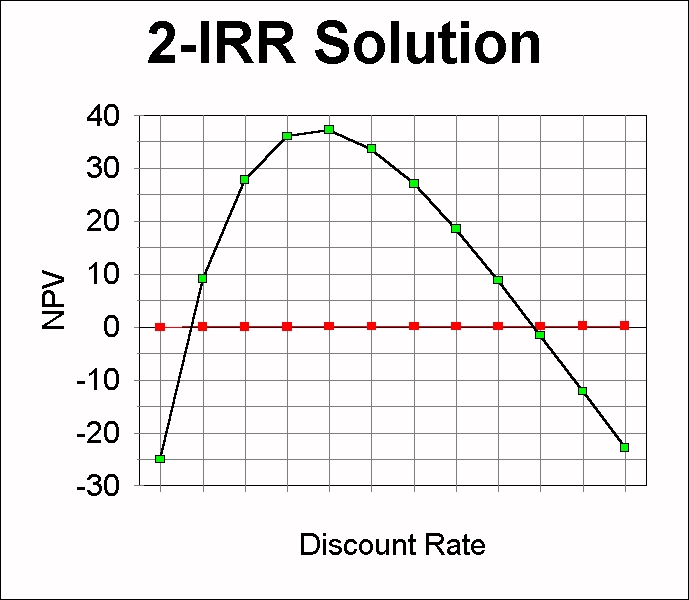

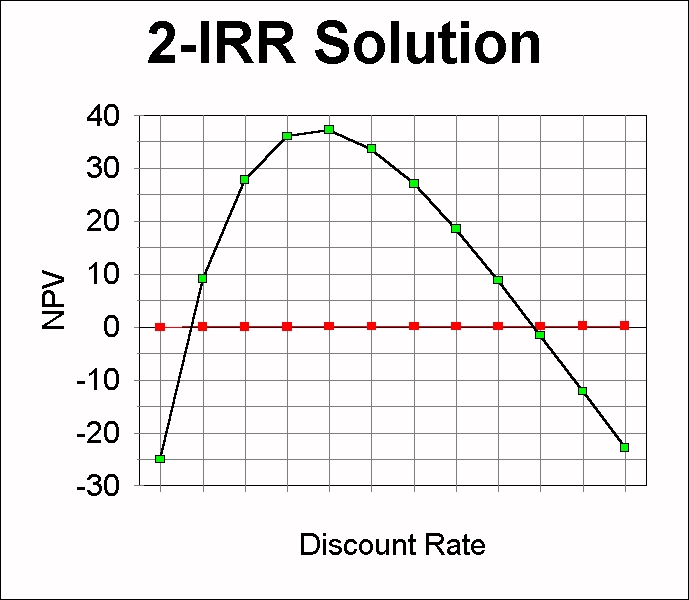

Internal Rate of Return (IRR)

The IRR represents the average annual expected rate of return on a project.

IRR is defined as the discount rate that makes NPV = 0.

An NPV profile is

a graph that relates the NPV of a project to changes in the discount rate.

The point at which the NPV profile crosses the horizontal (discount rate)

axis gives the IRR of the project.

Advantages of IRR:

- It is reasonably easy to calculate, especially with a financial calculator

or a spreadsheet.

- It is easy to understand, since it represents a percentage rate of

return.

- It usually gives the same decision (accept or reject) as NPV.

Calculations:

If the project only has one expected inflow and one outflow as in Project

3, the calculation is simply as follows:

| PV |

-2000 |

| FV |

10000 |

| n |

15 |

| i? |

11.33% |

| PMT |

0 |

If the project has equal annual cash flows as in Project 5, the calculation

is:

| PV |

-2000 |

| FV |

0 |

| n |

15 |

| i? |

11.12% |

| PMT |

280 |

If the project has equal annual cash flows with an extra amount at the

final period, the calculation is:

| PV |

-2000 |

| FV |

670 |

| n |

8 |

| i? |

10.87% |

| PMT |

330 |

If the cashflows do not fit into any of the above patterns, then the

use of an NPV profile and some trial and error may be needed.

The decision criteria for IRR is to compare the project's IRR to a hurdle

rate, which should be based on the company's risk adjusted cost

of capital.

If IRR > Cost of Capital, then the project will create

value if accepted.

If IRR < Cost of Capital, then value will be destroyed

if the project is accepted.

IRR Shortcomings:

- The IRR computation does not necessarily produce a unique solution.

That is, there could be more than one IRR for a project, in which case

none can be used. An IRR is produced for each change of sign in the cash

flow stream.

For example, consider a project that has a $1,000 cost, one

expected cash inflow of $1,200 at t=1 and one later inflow of -225 at t=15.

The NPV Profile for the project looks like this:

This

project has two IRR's -- one at 1.5% and one at 17.5%. In this situation,

both are correct and neither are correct. It is best not to use IRR in

this case and use just NPV instead.

- The calculation of IRR assumes that all annual cash flows are reinvested

in another project with the same IRR over the remaining life of the investment.

This tends to overstate the actual expected return on high IRR projects

while understating the expected return on low IRR projects.

- IRR can be easily abused by failing to set the hurdle rate appropriately.

The correct hurdle rate is the cost of capital of the company, adjusted

for the risk of the project.

- IRR can give an incorrect decision signal (one that differs from the

signal given by NPV) if it is used to rank mutually exclusive projects.

The example used in class referred to Project 7 and 8. Project 7 has the

higher IRR but the lower NPV. The correct ranking is to take the project

with the higher NPV per dollar of investment (PI) and per year (EAA).

Modified Internal Rate of Return (MIRR)

MIRR provides a "fix" for some of the shortcomings of IRR

while maintaining its desirable characteristics. Its advantages are:

- It always produces a unique solution.

- It assumes that cash flows are reinvested at the average rate of return

(the cost of capital) instead of at the IRR. This produces a more conservative

estimate of the the average annual expected return on the project.

- It produces a more dependable (but not perfect) ranking of mutually

exclusive projects.

Calculation of MIRR:

- Compute the total future value of all cash flows (except the one at

time zero) at the last year of the project's life. Use the appropriate

discount rate (the risk-adjusted cost of capital) to compute this future

value.

- Compute the annually compounded rate of interest that relates the total

future value to the project's initial cost. This is the MIRR for the project.

For example, consider Project 2:

|

Time |

CF |

FV |

| 1 |

1666 |

2015.86 |

| 2 |

334 |

367.40 |

| 3 |

165 |

165 |

|

Total FV |

2548.26 |

| PV |

-2000 |

| FV |

2548.26 |

| n |

3 |

| PMT |

0 |

| i? |

8.41 |

What Firms Actually Use

Damodaran Text Table10.11 Page 312

|

Technique |

Primary |

Secondary |

|

Number |

Percent |

Number |

Percent |

|

IRR |

288 |

49 |

70 |

15 |

|

ARR |

47 |

8 |

89 |

19 |

|

NPV |

123 |

21 |

113 |

24 |

|

PB |

112 |

19 |

164 |

35 |

|

PI |

17 |

3 |

33 |

7 |

|

Source: Kim, Crick, and Kim (1986) |

Payne, Heath, and Gale; Journal of Financial

Practice and Education - Spring/Summer 1999

IMPORTANCE OF TECHNIQUES

ACROSS ALL US RESPONDENTS

| Technique |

Rank |

Relative Rank |

| IRR |

1 |

1.73 |

| NPV |

2 |

2.00 |

| PB |

3 |

2.59 |

| DPP |

4 |

3.34 |

| ARR |

5 |

3.53 |

| MIRR |

6 |

3.97 |

IMPORTANCE OF TECHNIQUES

BY SIZE OF RESPONDENT

| Technique |

Quartile 1

(Smallest) |

Quartile 2 |

Quartile 3 |

Quartile 4

(Largest) |

| PB |

1 |

2 |

3 |

3 |

| DPP |

3 |

3 |

4 |

4 |

| ARR |

4 |

3 |

5 |

5 |

| IRR |

2 |

1 |

2 |

2 |

| MIRR |

4 |

4 |

6 |

6 |

| NPV |

1 |

2 |

1 |

1 |

Capital Budgeting Framework

Uses:

Incremental Analysis

After tax cash flows

Operating cash flows only

Test for inclusion of cash flows:

Does a change in the accept/reject decision change the cash flow in

question?

Net Initial Outlay:

| - |

Price of new asset |

| - |

One-time costs |

| + |

Sale of existing asset(s) |

| +- |

Tax effect on sale |

| +- |

Change in NWC |

| - |

Opportunity costs |

|

Net initial outlay |

Note: The sign on "CHANGE" is determined by (New - Old)

Caution: Do not include sunk costs!

Periodic (recurring) Cash Flows:

| + |

Change in Sales or Revenue |

| - |

Change in Operating Expenses |

| - |

Change in Depreciation |

|

Change in Operating Income |

| +- |

Change in after-tax Income |

| + |

Change in Depreciation |

| - |

Change in NWC in this period |

|

Change in Operating Cash Flow |

Note: Watch for opportunity costs, sales erosion, and allocated overhead.

Terminal Cash Flows:

|

Change in Operating Cash Flow |

| +- |

Recovery of Net Working Capital |

| +- |

Change in After Tax Salvage Value |

|

Final Period Cash Flow |